ALLEGRO MICROSYSTEMS (ALGM)·Q3 2026 Earnings Summary

Allegro MicroSystems Surges 12% as e-Mobility Drives 29% Revenue Growth

January 29, 2026 · by Fintool AI Agent

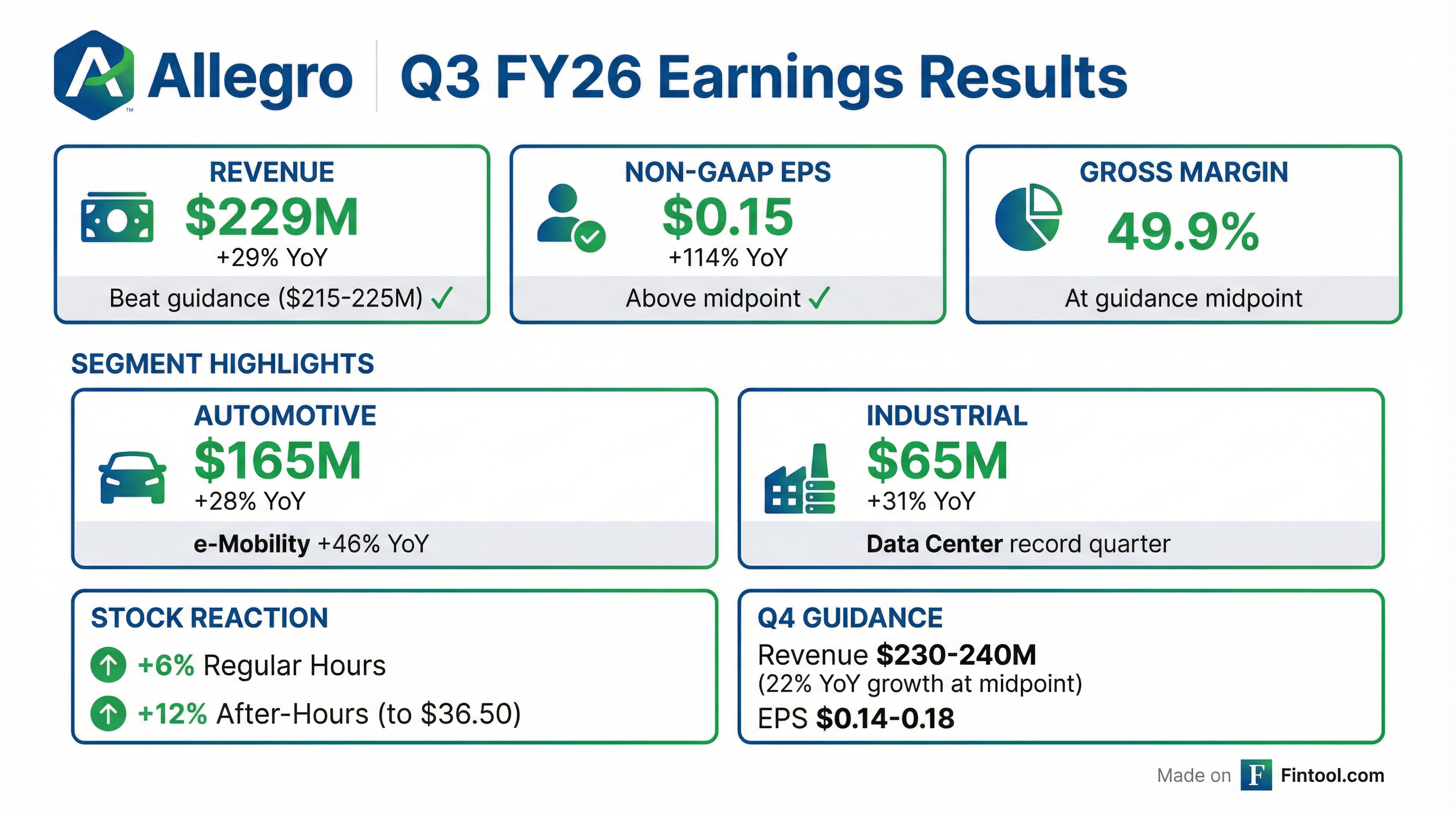

Allegro MicroSystems delivered a strong Q3 FY26 with revenue of $229 million, exceeding the high end of guidance by $4 million and growing 29% year-over-year. Non-GAAP EPS of $0.15 more than doubled from $0.07 a year ago, landing above the midpoint of guidance. The stock surged nearly 6% during regular trading and extended gains to +12% in after-hours trading, reaching $36.50.

Did Allegro Beat Earnings?

Yes — Allegro beat on both the top and bottom line.

The beat was driven by broad strength across both Automotive and Industrial segments, with e-Mobility (+46% YoY) and Data Center leading their respective categories.

What Did Management Say?

CEO Mike Doogue highlighted the breadth of the recovery:

"We delivered strong third quarter results, with sales of $229 million exceeding the high end of our guidance range. Additionally, non-GAAP EPS more than doubled year-over-year to $0.15. This performance was driven by broad strength in Automotive sales, which grew 28% year-over-year, including a 46% increase in e-Mobility."

Management also emphasized several forward-looking positives:

- Growing bookings and backlog — demand visibility improving

- Design wins accelerating — year-to-date wins "significantly" ahead of prior year

- Analyst Day scheduled for February 18, 2026 to detail long-term strategy and target model

What Changed From Last Quarter?

The most notable shift: Industrial is accelerating faster than Automotive on a sequential basis, with Data Center hitting another record quarter. This diversification beyond auto is a key part of Allegro's strategy to reach their long-term target model of >58% gross margins and >32% operating margins.

Segment Deep Dive

Automotive (72% of Revenue)

Key Design Wins:

- Multiple electronic power steering (ADAS) wins with broad global OEM representation

- Steer-by-wire wins with OEMs in North America, Europe, and China

- xEV wins for on-board chargers and high-voltage traction inverters

Important Context: Allegro remains 20% below peak automotive levels despite the strong YoY growth. CEO Doogue addressed this directly on the call, dismissing share loss concerns: "No, we don't think there's any evidence of share loss. In fact, we feel like we're driving the opposite." The slower recovery vs. peers is attributed to specific customer inventory dynamics that are now normalizing.

Tier 1 auto inventories remain "fairly lean" with no meaningful inventory build despite supply chain concerns.

Industrial & Other (28% of Revenue)

Data Center hit a new record at 10% of total company sales, up from 8% last quarter. The business is driven by three product categories with different margin profiles:

Management reaffirmed their data center content opportunity: $150 per traditional rack today, scaling to $425 for AI racks — and notably, this holds even with increased liquid cooling architectures.

What Did Management Guide?

CFO Derek D'Antilio highlighted continued financial discipline:

"Earlier this month, we repriced our term loan down another 25 basis points to SOFR plus 175 basis points resulting in an additional $700,000 reduction in annualized interest expense. This repricing reflects our lenders' confidence in our business model and financial discipline."

Q&A Highlights

On Channel Dynamics & Inventory:

"For the past about 4 quarters leading up to this, we had significant POS far exceeded sell-in as they were burning down inventories. Our distributor inventories are down nearly 50% over the last almost 5 quarters. This quarter, POS and sell-in were close to each other." — CFO Derek D'Antilio

On Gross Margin Drivers (China Mix): China was 30% of sales in Q3, which drove gross margin about 10 basis points below the midpoint of guidance. Q4 should benefit from lower China mix due to Chinese New Year.

On Pricing Environment:

"I've characterized this year's pricing environment as one where the reductions are very low, single-digit reductions... More favorable in 2026 than historical." — CEO Mike Doogue

On Operating Leverage: Using Q4 midpoint guidance, FY26 sales growth of "just over 20%" will more than double non-GAAP EPS. This comes from 60% gross margin drop-through and disciplined OpEx management.

On Q4 Segment Mix: Industrial will lead Q4 growth, with data center continuing to drive. Auto expected flat-to-marginally-down due to Chinese New Year impact.

On OpEx Outlook: After Q4 payroll tax resets, expect ~$2M sequential step-down in OpEx in June quarter as variable comp resets, then inflationary increases thereafter.

On Balance Sheet: Net leverage ratio approaching 1x exiting Q4. The company repriced its term loan to SOFR + 175bps, reflecting lender confidence. Cash of $163M provides ~6 months of OpEx + CapEx coverage.

How Did the Stock React?

The stock's strong reaction contrasts sharply with last quarter's -10% drop on Q2 FY26 results, despite that quarter also beating guidance. The difference: Q3 showed accelerating growth (29% YoY vs 14% in Q2) and expanding margins (15.4% operating margin vs 13.9%), suggesting the turnaround is gaining momentum.

Historical Earnings Reactions

Forward Catalysts

-

Analyst Day (Feb 18, 2026) — Management will detail long-term strategy, growth drivers, and target financial model. CEO Doogue promised to show data on how design wins support "a robust growth number."

-

48V Transition — Allegro is "well-positioned" for the automotive industry's shift to 48V systems, which offer higher efficiency for EVs and hybrid vehicles.

-

AI Data Center Expansion — Content opportunity scales directly with AI workload energy consumption. $150 content per traditional rack growing to $425 for AI racks — and this holds even with liquid cooling.

-

Robotics — Humanoid robots represent a significant content opportunity: up to 150 Allegro sensor ICs + 50 motor drivers per humanoid robot. Revenue ramp expected in 2-3 years as production scales from tens of thousands to hundreds of thousands of units. Notably, many robotics customers are existing automotive OEMs, allowing Allegro to leverage existing relationships and OpEx.

-

TMR Technology Adoption — XtremeSense TMR sensors offer a $1B SAM expansion. Current sensors are "mostly Hall today" but TMR is accelerating: "We're starting to accelerate activity with customers, accelerate share gains through the use of TMR in current sensing."

-

Isolated Gate Drivers — $2.7B SAM opportunity in high-voltage SiC/GaN designs. First silicon carbide gate driver now sampling to data center and xEV customers, with revenue expected in 18-24 months.

Key Risks

- Automotive Cyclicality — Despite strong results, the semiconductor industry remains cyclical and automotive production can be volatile

- Customer Concentration — Reliance on a limited number of large automotive OEMs

- China Exposure — 30% of sales from China in Q3, subject to geopolitical and trade policy risks

- Sanken Overhang — Former majority owner Sanken Electric still holds 32.5% and could sell shares after lockup expiration

Bottom Line

Allegro delivered a clean beat-and-raise quarter with accelerating revenue growth, expanding margins, and strong forward guidance. The e-Mobility business (+46% YoY) is firing on all cylinders, and Data Center is emerging as a meaningful growth driver. With the stock approaching its 52-week high and Analyst Day on the horizon, bulls have the wind at their backs.

Key numbers to watch:

- Can Q4 sustain >20% YoY growth?

- Will Analyst Day raise the long-term margin targets above 58% gross / 32% operating?

- Does Industrial continue to outpace Automotive sequentially?

Data sources: Earnings call transcript , company filings , earnings presentation , press releases . Stock prices from market data.